Small business loans for women

- 99.9% satisfied customers

- Fast online decision

- Any purpose loans

- Enjoy tax benefits

- Secured & unsecured loans

I want to borrow

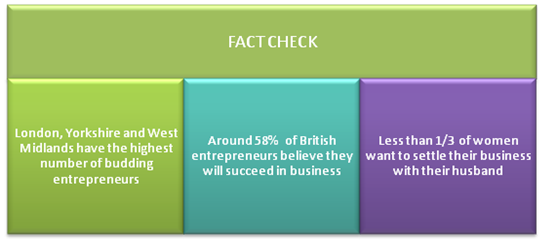

56.4% Women in the UK Want To Start Their Own Business

With this interesting figure and possibilities of an increase in the percentage of women entrepreneurs, we can talk about the significance of small business loans. All over the world, women business owners are considered strong and successful. They are super in management, perfect in handling stress, brilliant in decision-making. With the right backing of adequate funds, the ‘She’ part of population can contribute to the economy.

24CashFinances is a direct lending platform of business loans for womenwith rational deals and feature of personalised pricing. Among the thousands of borrowers, we have a considerable number of women business owners. The loans aim to offer financial ease on the one simple condition of repaying capacity. It means an applicant with a promising capacity to pay instalments can always get the best deals on instant approval.

Business loans work through a simple and predictable procedure that every fund seeker can follow easily without any stress. The terms and conditions are reasonable and not annoying.The process to apply is short and speedy. Every loan deal comes with a commitment of timely fund disbursal after approval.

The applicants can visit our website to calculate the monthly and annual cost of a certain loan amount

After working on the cost statistics, apply from the website only through a simple application form

We study the financial and personal details through online verification to release a final decision.

Once approved, we provide the final loan agreement, and once it is signed, we transfer the money online.

There are generic features for the loans, with some newly added ones to calm down the destruction caused by the corona pandemic. We try to satisfy the concern of the borrowers in every aspect. Whether it is about their concern on the maximum desired amount or the wish to get a lower rate, our team is always at work.

Loans designed specifically for women

Unlike the other lenders, we design specialised business loans for the specific needs of women entrepreneurs. Customisation prepares the deal to suit everyone from an ambitious wife to a single mother.

Women relationship managers on-demand

Sometimes, our women customers express the wish to have a female loan representative, and we happily fulfil that need. They are available from day to 11:00 pm in night.

Every deal accompanies doorstep service

The women borrowers can also ask for doorstep business loans. As we have experienced many run their business from their home, it is a significant service for them.

Fixed interest rate despite pandemic chaos

With the aim to give more certainty to the women users, the loan deals carry the fixed rate of interest. The borrowers can enjoy the fixed instalments without any anxiety about up and down in interest rates.

Acceptance to bad and fair credit score status

The only mandatory condition to qualify for business loans is a strong repaying capacity. If the applicant can prove that, we can offer instant approval. The incidents of delayed payments must not be consistent.

Change repayment plan in the middle of the tenure

Financial issues can occur anytime irrespective of whether a borrower is in the middle of the loan tenure. In case of any issue, the borrowers can contact us to change the repayment plan to a more suitable one.

Many existing borrowers for business loans for women have exploited the opportunity of the extended loan amount. The borrowers with good payment history with us always get a bigger maximum limit next time.

The women who are planning to enter the business world and have no credit history should not feel weak. According to our market research, most women think that investors and banks do not take them seriously.

At 24CashFinances, we judge two things -

With these two features, the fund seeker can always find a way to funds and then succeed in her entrepreneurial journey. Beyond the stereotypical perceptions about women business owners, we offer loans with rational lending policies.

Success does not see the size of a business; it can visit any commercial entity that is doing good in its sector. There are millions of small size businesses that are earning huge from a little working space. The world is digitised now, and you do not need to own a particular infrastructure to start a business. Women are exploring this opportunity, and they are doing well, which is why we approvesmall business loans for womenon flexible terms and conditions.

The conditions to qualify for funds are simple because the complete procedure happens online. With virtual verification of the personal and financial details, the applicant can get funds in a short while. Way to money for business progress is convenient; the need is to arrange every condition perfectly. Proper application has no chances of rejection.

Our only aim is to keep the confidence of our borrowers high, which can happen only if they will get a good experience from us. With the help of multiple features and traits added to our lending services, we make things smooth.

Higher approval rate with 99%

Timely reminders for repayments

Simple application procedure

Competitive rate of interest

Personalised pricing on all deals

Payment holiday despite bad credit

Seasonal and festive offers

24CashFinances is always ready to support the spirit of businesswomen in the world of commerce. Our loan deal statistics always match the financial needs of the borrowers. We give certainty through logical calculations through a loan calculator. From thestart up business loans for women to the funding options for the established ones, we have easy funding choices.

What are small business loans for women?

How is a small business loan for women different?

Can I get a small business loan for women with bad credit?

How do I qualify for a small business loan for women?

What are the common uses of a small business loan for women?

Small business loans for women can be used for multiple purposes, such as: